All Categories

Featured

Table of Contents

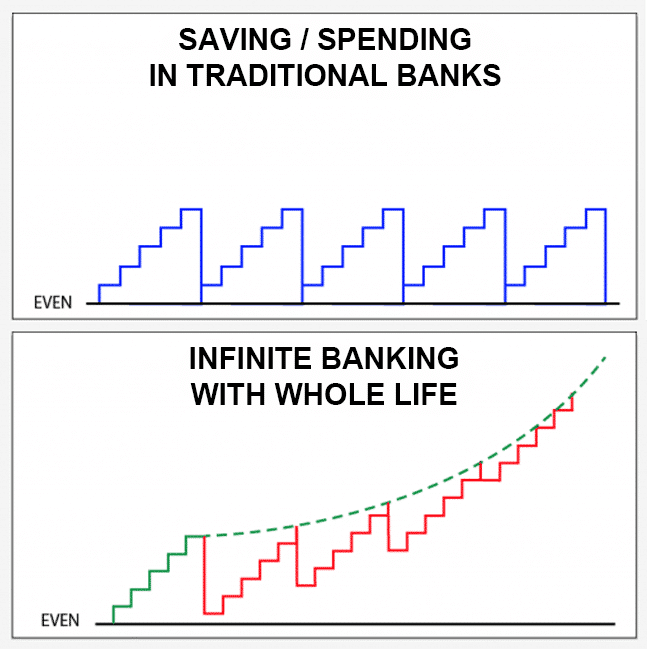

For many people, the greatest problem with the limitless financial concept is that preliminary hit to early liquidity triggered by the expenses. This disadvantage of infinite banking can be reduced considerably with correct policy style, the initial years will certainly always be the worst years with any kind of Whole Life policy.

That stated, there are particular boundless financial life insurance policy policies designed mostly for high very early money worth (HECV) of over 90% in the very first year. The long-term efficiency will certainly often significantly lag the best-performing Infinite Banking life insurance coverage plans. Having access to that added 4 numbers in the initial couple of years may come with the expense of 6-figures down the roadway.

You really obtain some substantial long-lasting benefits that help you recover these early expenses and after that some. We locate that this prevented early liquidity trouble with unlimited financial is more psychological than anything else as soon as completely checked out. If they definitely required every penny of the money missing from their infinite financial life insurance plan in the initial couple of years.

Tag: boundless financial idea In this episode, I talk about funds with Mary Jo Irmen who teaches the Infinite Banking Concept. With the rise of TikTok as an information-sharing platform, financial suggestions and methods have located an unique means of dispersing. One such approach that has actually been making the rounds is the infinite financial principle, or IBC for short, gathering recommendations from celebs like rapper Waka Flocka Flame.

Within these plans, the cash worth expands based on a price set by the insurance firm. When a substantial cash worth gathers, insurance holders can get a cash value loan. These finances vary from traditional ones, with life insurance policy working as collateral, implying one might shed their insurance coverage if borrowing exceedingly without sufficient cash worth to sustain the insurance coverage costs.

And while the attraction of these policies appears, there are natural constraints and dangers, necessitating persistent cash money value tracking. The technique's authenticity isn't black and white. For high-net-worth individuals or entrepreneur, especially those utilizing approaches like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and compound development might be appealing.

Infinite Bank Concept

The attraction of unlimited financial doesn't negate its obstacles: Cost: The foundational requirement, an irreversible life insurance policy plan, is more expensive than its term counterparts. Eligibility: Not everybody receives entire life insurance coverage as a result of rigorous underwriting procedures that can exclude those with details health and wellness or way of living conditions. Intricacy and threat: The elaborate nature of IBC, coupled with its dangers, might deter several, especially when simpler and less risky alternatives are offered.

Designating around 10% of your monthly revenue to the policy is just not feasible for the majority of people. Using life insurance policy as an investment and liquidity resource needs self-control and tracking of policy money value. Seek advice from a financial consultant to establish if boundless financial straightens with your concerns. Part of what you read below is just a reiteration of what has already been claimed above.

So prior to you obtain right into a situation you're not planned for, recognize the complying with initially: Although the concept is frequently sold thus, you're not really taking a loan from yourself. If that were the situation, you would not have to repay it. Rather, you're obtaining from the insurer and have to settle it with passion.

Some social media articles suggest using money value from entire life insurance coverage to pay down credit score card financial obligation. When you pay back the loan, a part of that passion goes to the insurance business.

For the initial numerous years, you'll be repaying the compensation. This makes it exceptionally tough for your plan to collect worth during this moment. Whole life insurance expenses 5 to 15 times more than term insurance coverage. Many people just can not afford it. Unless you can pay for to pay a couple of to a number of hundred dollars for the next decade or even more, IBC won't work for you.

Infinite Banking Concept Spreadsheet

Not everybody needs to count only on themselves for economic security. If you need life insurance policy, here are some useful ideas to think about: Consider term life insurance. These policies offer coverage throughout years with substantial financial responsibilities, like mortgages, trainee car loans, or when looking after little ones. Make certain to go shopping about for the ideal price.

Copyright (c) 2023, Intercom, Inc. () with Booked Typeface Name "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Typeface Name "Montserrat".

Infinite Financial Group

As a certified public accountant specializing in property investing, I have actually brushed shoulders with the "Infinite Financial Principle" (IBC) extra times than I can count. I have actually even talked to professionals on the subject. The main draw, apart from the obvious life insurance policy benefits, was constantly the idea of accumulating cash money worth within an irreversible life insurance policy plan and borrowing against it.

Sure, that makes good sense. But honestly, I always assumed that cash would certainly be much better invested straight on investments instead of funneling it through a life insurance coverage policy Till I discovered exactly how IBC might be integrated with an Irrevocable Life Insurance Policy Count On (ILIT) to develop generational wide range. Let's start with the essentials.

Infinite Banking Examples

When you borrow versus your plan's cash money value, there's no collection payment schedule, giving you the liberty to take care of the finance on your terms. On the other hand, the cash money value remains to grow based on the plan's guarantees and returns. This configuration permits you to access liquidity without disrupting the long-lasting growth of your plan, provided that the finance and rate of interest are taken care of sensibly.

The process proceeds with future generations. As grandchildren are birthed and grow up, the ILIT can purchase life insurance policy policies on their lives as well. The count on then builds up numerous plans, each with expanding cash money worths and survivor benefit. With these plans in position, the ILIT successfully becomes a "Household Financial institution." Household members can take loans from the ILIT, utilizing the cash worth of the policies to fund investments, begin services, or cover significant expenditures.

A critical aspect of handling this Family members Bank is the usage of the HEMS standard, which stands for "Health, Education, Maintenance, or Support." This standard is frequently included in count on agreements to route the trustee on just how they can distribute funds to recipients. By adhering to the HEMS standard, the trust fund guarantees that distributions are produced important needs and lasting support, safeguarding the count on's assets while still offering for member of the family.

Increased Flexibility: Unlike rigid financial institution financings, you manage the repayment terms when borrowing from your own policy. This permits you to framework payments in a manner that straightens with your business money flow. infinite banking strategy. Better Capital: By funding business costs via plan fundings, you can potentially free up cash money that would or else be locked up in standard car loan settlements or equipment leases

He has the very same devices, yet has actually likewise constructed added cash worth in his plan and got tax advantages. Plus, he now has $50,000 offered in his plan to utilize for future opportunities or expenses., it's vital to watch it as even more than just life insurance.

Infinite Banking Concept Explained

It has to do with producing an adaptable financing system that offers you control and supplies numerous advantages. When utilized tactically, it can match other investments and organization techniques. If you're interested by the capacity of the Infinite Financial Principle for your business, below are some actions to think about: Enlighten Yourself: Dive deeper right into the idea through respectable publications, workshops, or appointments with educated specialists.

Latest Posts

Infinite Banking Concept Scam

Infinite Banking Concept Wiki

Life Insurance - Create Your Own Bank - Prevail